carried interest tax loophole

2019 Instructions for Form 565 Partnership Return of Income. Your Tax Basis.

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days.

. Under the law funds must hold assets for more than three years for gains to be considered long-term. Your tax on the dividend is 1275 15 percent x 8500. Its 24 marginal tax rate brackets began at 20 climbing as high as 91.

For example if you own an S corporation and invest 10000 in the stock and also lend the S corporation 5000 your tax basis would be 15000 and is the amount you have at risk. House Democrats are divided over a bill that would let the rich reduce their federal tax bill through so-called carried interest The Democratic proposal would end a provision called the carried interest loophole that allows Wall Street partners to pay the 15 capital gains tax rate on half their profits from carrying out trades. Assume your tax rate is 15 percent.

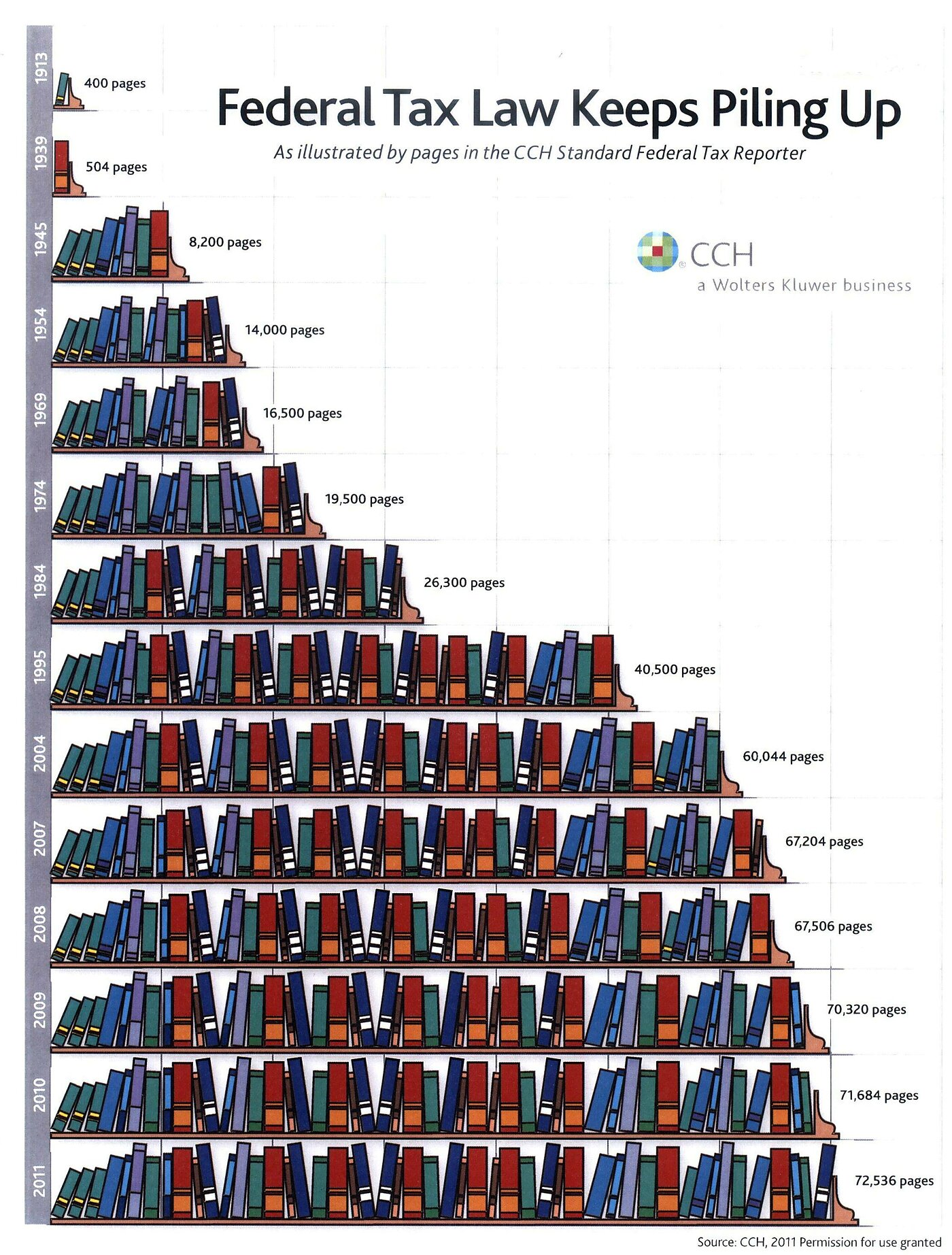

568 the amounts of tax-exempt interest income other tax-exempt income and nondeductible expenses from federal Schedule K 1065 lines. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided. Taxation of Carried Interest.

At its most basic tax-loss harvesting involves intentionally selling poorly performing investments for a loss and reinvesting the proceeds back into the market. 1639 would treat the grant of carried. Your personal income tax rate is 15 percent.

Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income. 16 During this era the grantor trust rules served an important purpose. Loophole Closure and Small Business and Working Families Tax Relief Act of 2019.

Your initial tax basis is in an S corporation is equal to your investment in the business plus loans you make to the business. The proposed Ending the Carried Interest Loophole Act S. The Tax Cuts and Jobs Act made some changes to the carried interest rule.

Do not print fractions. Preservation of this structure in an environment where taxpayers were. A re you an unwitting tax evaderI only ask because quite a few investors seem unaware that fund accumulation units attract income tax on dividends just as much their more transparent income unit cousins.

1-800-759-2248 Start A Delaware Company. The compact foldable design launched a million copy cats around the world including. When the grantor trust rules were originally codified by Congress in 1954 15 the income tax structure was significantly more progressive than it is today.

The proposed Senate language on ending the carried interest loophole which allows investment fund managers to be taxed at capital gains rates instead of income tax rates is stronger than. Total tax paid is 2775 corpooration. In general for taxable years beginning on or after January 1 2015 California law conforms to the Internal Revenue Code IRC as of January 1 2015.

Thats almost 28 percent of the 10000 gain 277510000 Now assume the same facts except youre organized as an LLC a pass-through entity. Click here to learn about LLC tax benefits deductions loopholes rates and advantages plus tax tips for your LLC. The first DJI Mavic turned the world of consumer drones on its head when it was released back in late-2016.

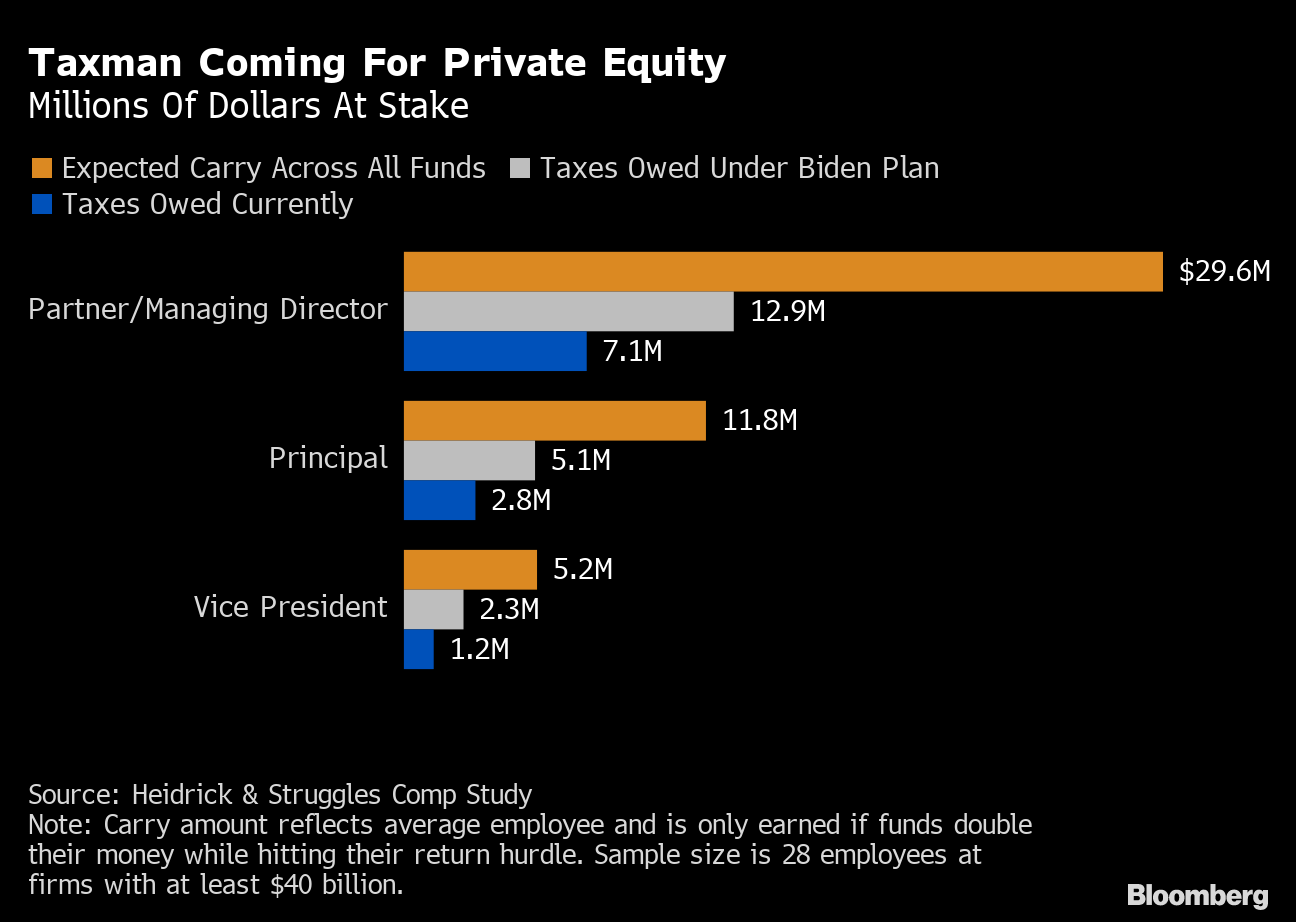

References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC. Carried interest has long been a controversial political issue criticized as a loophole that allows private-equity managers to secure a reduced tax rate. The top federal rate on dividend income for individual taxpayers is 238 20 for those in the top marginal tax rate plus a 38 net investment tax to fund the Affordable Care Act.

Accumulation units are a class of share that automatically reinvests dividends or interest straight back into your ETF or mutual fund1 In contrast income. Talk to a Pro. Question C is expressed in decimal format and carried to four decimal places ie 335432.

What We Re Seeing Is A Risk Off Flight To Boring Safe Assets Fund Bad Timing Risk

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Where China Gained And The U S Lost World Taking Over The World Map

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Pin By Ahmed Cure On Alcohol Beer Wine In 2022 Alcohol Fermentation Prebiotics

Carried Interest In Venture Capital Angellist Venture

The Commander In Chief Has Again Voiced His Displeasure With The Carried Interest Tax Provision Which Allows Many Pe Inv Philip Iv Of France White House Tours

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

His Word Means Nothing Words Mean Nothing True Words Truth

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Carried Interest In Private Equity Calculations Top Examples Accounting

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Debunking Fiscal Myths There Is No Loophole For Carried Interest Cato At Liberty Blog

Carried Interest In Private Equity Definition Examples Accounting Youtube

Carried Interest Loophole Take On Wall Street

Carried Interest Definition History And Examples Marketing91